Blog home

PRODUCT

FEB 24, 2022

Crypto Taxes: 5 Tips To Help You During Tax Season

As we inch closer to April, many of us start bracing for tax season. While some might find the prospect of filing crypto taxes daunting, we at Gemini aim to simplify this process for our users through partnerships and by providing helpful information.

Today, we’ll go through five tips that can help you better understand your crypto taxes, including who will receive Forms 1099-MISC and what kinds of crypto earnings must be reported on your taxes. We’ll also outline our integration with TaxBit, which allows eligible Gemini users to create free accounts.

Below are five tips that can help you on your 2021 crypto taxes:

- Who owes crypto taxes? All crypto assets earned by U.S. persons (U.S. citizens or residents) are taxable and required to be reported on a U.S. tax return regardless of whether you receive a tax form from Gemini (e.g. a Form 1099-MISC, which we will get into next). NOTE: if your only activity was the purchase of crypto assets with fiat currency and you had no earnings or dispositions, you should not owe taxes on your crypto.

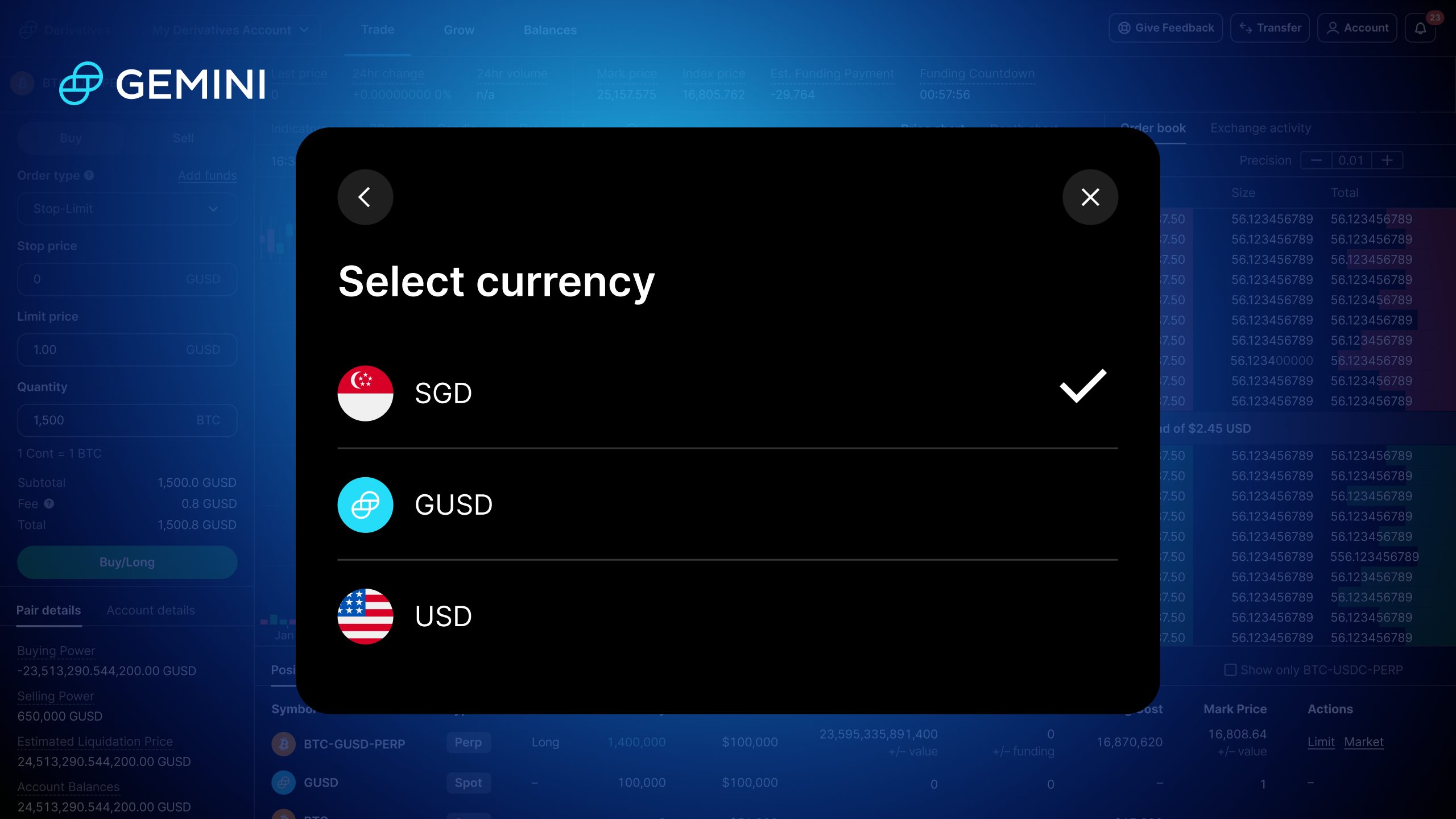

- Who will receive a Form 1099-MISC from Gemini? Gemini issues Forms 1099-MISC for non-exempt U.S. exchange account holders who have earned more than USD 600 (or USD equivalent) in income during the relevant calendar year. You can download your Form 1099-MISC (or confirm you did not receive one) in the “Statements and History'' section on the “Account” page on the Gemini website or mobile app.

- What kinds of crypto earnings are taxable? The IRS has issued guidance on the taxation of crypto activities including earnings, gains, losses, and donations. How these transactions are taxed may vary depending on your personal tax situation, which is why it is critical for each filer to consider their own situation independently. Crypto assets can also be earned through bonuses or promotions.

- How to access your transaction history: When preparing your U.S. tax filing obligations, you may be required to reference your transaction data. You can access your transaction history by following these steps once you’re signed in to your account: 1) Navigate to https://exchange.gemini.com/history. 2) Click the “Transaction History” tab. 3) Click the download button and select your desired date range. Click "Download.xlsx" and the transaction history will download onto your device.

- How to find IRS information about crypto taxes: We always recommend that you consult a tax advisor to determine your personal tax obligations, but if you want to do some research yourself on IRS regulations covering crypto, here are some resources: the IRS’ FAQ on Virtual Currency Transactions, and IRS Publication 544 on how gains and losses from crypto dispositions may be taxed differently for different types of investors.

Another way that Gemini supports you on your crypto journey is through our partnership with crypto tax platform TaxBit. As a Gemini user, you may have access to a free TaxBit account, which could drastically simplify your crypto tax reporting process.

Create your free TaxBit account here.

TaxBit allows you to link your Gemini account — and any other TaxBit Network exchange account — to a central location, determine a tax lot selection method, and produce a Form 8949 that will determine your total gain or loss from crypto transactions to report on a Form 1040.

For more information about crypto taxes, you can explore our FAQ.

We are dedicated to providing you with the most seamless crypto experience possible, and equipping you with information to help you accurately report your crypto earnings is an important part of that process. We are thrilled to be on this journey with you as we continue on our mission to unlock the next era of financial, creative, and personal freedom.

Onward and Upward!

Team Gemini

Disclaimer: The information above is provided for general informational purposes and should not be considered tax advice. Please consult a tax advisor to determine your personal tax obligations that result from your activities on Gemini, including dispositions, earnings, and rewards.

RELATED ARTICLES

WEEKLY MARKET UPDATE

MAY 09, 2024

FTX Customers To Be Paid Back, Robinhood Receives Wells Notice, and Marathon Digital To Join S&P SmallCap 600

WEEKLY MARKET UPDATE

MAY 02, 2024

Crypto Market Slides, Then Rallies After Federal Reserve Holds Steady

DERIVATIVES

MAY 02, 2024