Institutions

INSTITUTIONAL PRODUCTS

WHO WE SERVE

GeminiThe 2024 Crypto Trend Report.

From the desk of Marshall Beard: Gemini Chief Strategy Officer

2024 will be a watershed year for crypto.

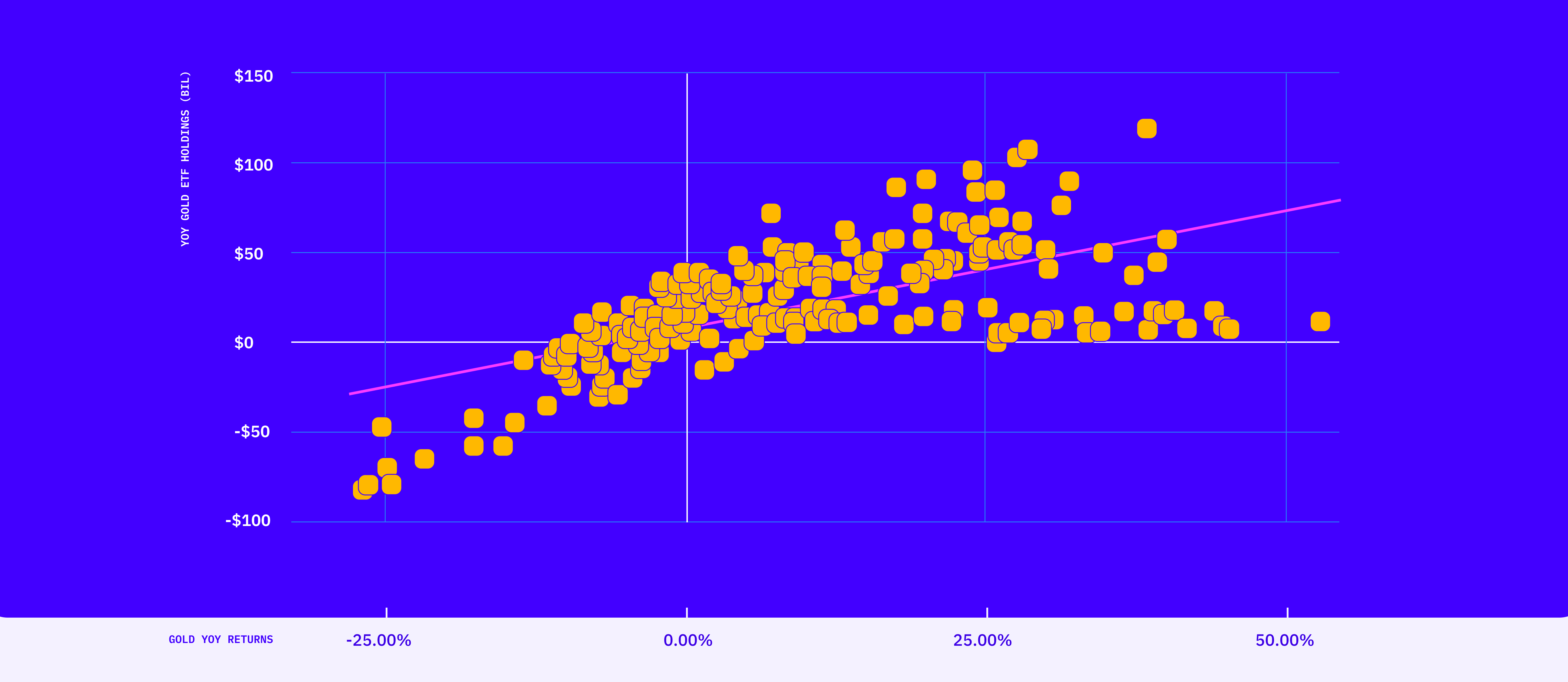

The price of bitcoin stands to increase 123% within a year of a spot bitcoin ETF approval. An increase in bitcoin holdings after the approval will likely drive price activity based on the historical relationship of gold holdings and returns.*

The approval of a spot bitcoin ETF would mark a significant milestone in the journey of legitimizing bitcoin as an institutional-grade investment. It’s an affirmation that bitcoin is real, resilient, and here to stay.

The approval of a spot bitcoin ETF could open the $36.7 trillion retirement fund market to the crypto asset class by giving US investment funds access to bitcoin.

A massive inflow of capital to crypto is expected to drive price activity.

What do you believe will be the most impactful outcome of an ETF approval?

James Seyffart | @JSeyff

ETF Research Analyst, Bloomberg Intelligence

The biggest impact will be opening access to spot bitcoin exposure in an efficient manner on the traditional financial rails. This is the easiest and simplest path in my opinion for advisors and some institutions to get exposure to spot bitcoin. It will also likely be the vehicle of choice for individuals looking for bitcoin exposure within tax advantaged accounts like IRAs. Don't underestimate the impact of the convenience and efficiency that the ETF wrapper can provide.

The biggest potential hurdle (and it's rather unlikely in our view) is that the SEC could still technically deny and delay if they really wanted. Other than that, we can't know for certain what problems or topics are being discussed by the SEC and potential issuers but it likely centers around the back-end plumbing for a spot Bitcoin ETF. Namely who will handle the actual Bitcoin when money or Bitcoin flows into or out-of the ETF. There are 12 spot Bitcoin ETF filings and there are numerous variations on how exactly each fund will handle that plumbing.

Jan van Eck | @JanvanEck3

CEO, VanEck

An ETF approval has become an important symbolic step in bitcoin’s acceptance and popularity. It is not normal that regulatory approval of an investment in the U.S. has driven asset prices, but it will be an important, undoable political hurdle—and Bitcoin has faced many.

Amanda Cassatt | @amandacassatt

CEO, Serotonin and Author, Web3 Marketing

I foresee a surge in institutional adoption driven by the growth of ETFs and financial institutions producing stablecoins. The catalyst? Familiar, trusted wealth managers reaching out privately to their existing customers, advocating for the benefits of investing in crypto.

Peter McCormack | @PeterMcCormack

Podcast host, What Bitcoin Did and Chairman, Real Bedford Football Club

ETF speculation has been rife this year, with increasing signs that the SEC will finally approve not one but multiple ETFs, including those from some of the largest financial institutions in the world. If approved,we will likely see a massive increase in the price of Bitcoin as a wall of institutional money will seek exposure to Bitcoin. ETFs have split the crowd as some see the massive increase in awareness and validation from these institutions as necessary for the growth of Bitcoin. In contrast, others fear that these institutions may flex pressure on the direction of Bitcoin in the future while centralising large pools of Bitcoin capital. The most important thing Bitcoiners can do is ensure that the foundational principles of Bitcoin are maintained.

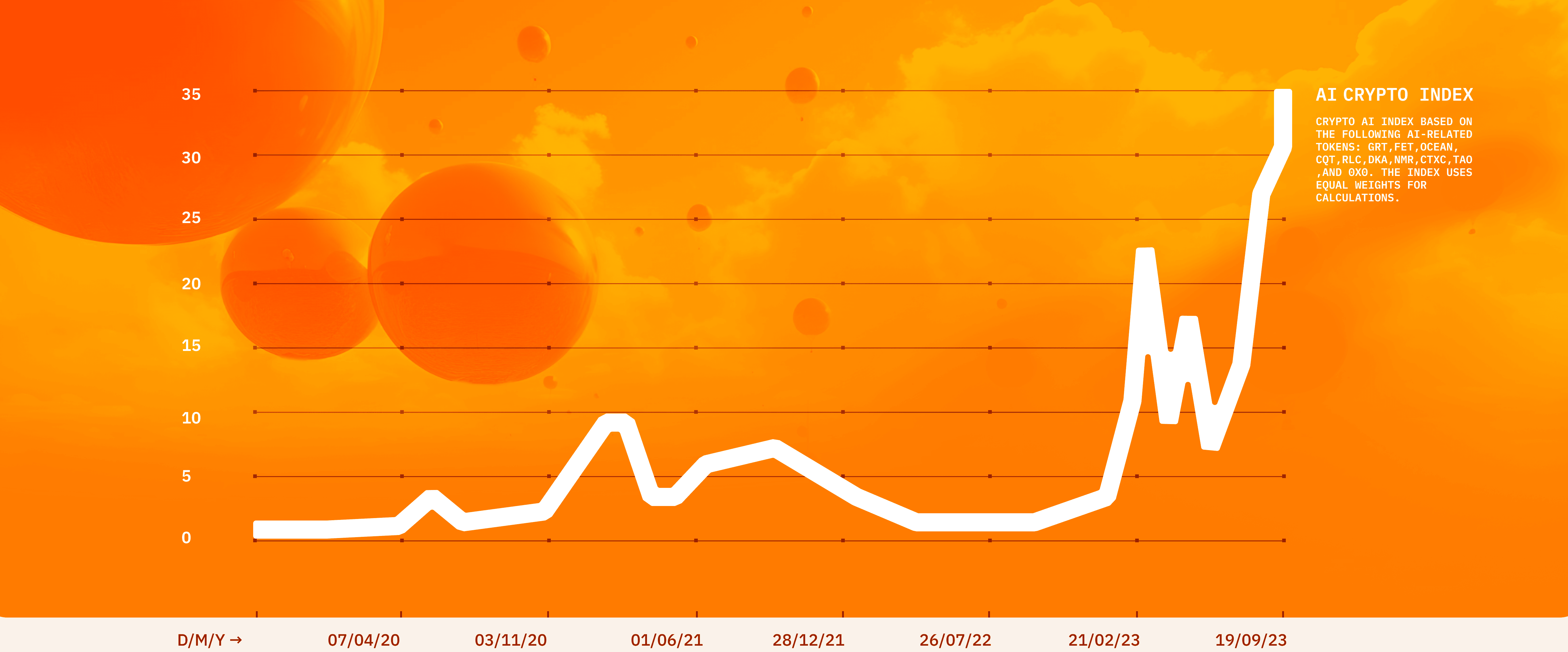

AI-related tokens reflect a notable surge in prices, signaling a growing interest and confidence in the market.

The intersection of artificial intelligence (AI) and crypto has ushered in a new era of possibilities, promising to redefine the entire crypto ecosystem

AI and crypto each represent enormously powerful modes of technological capability, but they likewise have notable shortcomings that have yet to be addressed. Thoughtful integration of these two revolutionary technologies can build a pathway where their benefits address the other’s weaknesses.

AI innovations revolutionize smart contracts, bolster secure data solutions, enable transparent large language models, and combat disinformation.

Which advancement in AI and crypto do you find the most interesting?

Amanda Cassatt | @amandacassatt

CEO, Serotonin and Author, Web3 Marketing

We're observing an increase in projects combining web3 style monetization, provenance tracking, and digital content attributions, or payment-capable agents, merging AI and web3 technologies into usable forms. The AI’s asymmetric ability to create content, more than humans can ever process, will soon see us default to assuming content is fake, relying on on-chain attestations for verification. In the near future, most payments will be made on-chain by AI agents on behalf of people. These agents will interface with the blockchain’s UX, bundling their

transactions and presenting them to humans in easy-to-understand ways. We also foresee code audit companies developing versions of copilot for smart contract writers, so AI can assist in verifying the quality of smart contract code during creation, not just post-creation. (Post-creation AI code audits are useful, too.) The argument that DeFi protocols are more susceptible to bugs, hacks, and errors, one of the last remaining arguments for CeFi over DeFi, will soon be obsolete, thanks to AI assistance!

Jack Inabinet | @BanklessHQ

Analyst, Bankless

Crypto + AI could be an explosive combination. While early activity is largely circulating valueless projects looking to tap into the hype, the promise is still massive. From AI agents that will tap crypto markets for access to financial networks, to decentralized compute protocols opening access to GPUs to all, to projects reenvisioning blockchains as marketplaces for artificial intelligence outputs, there’s a lot to be excited about. Which use case manages to foster the first sparks of adoption remains to be seen, but the unbounded freedom of crypto combined with the unknown capabilities of AI present a potent cocktail of opportunity we’ll be watching in 2024.

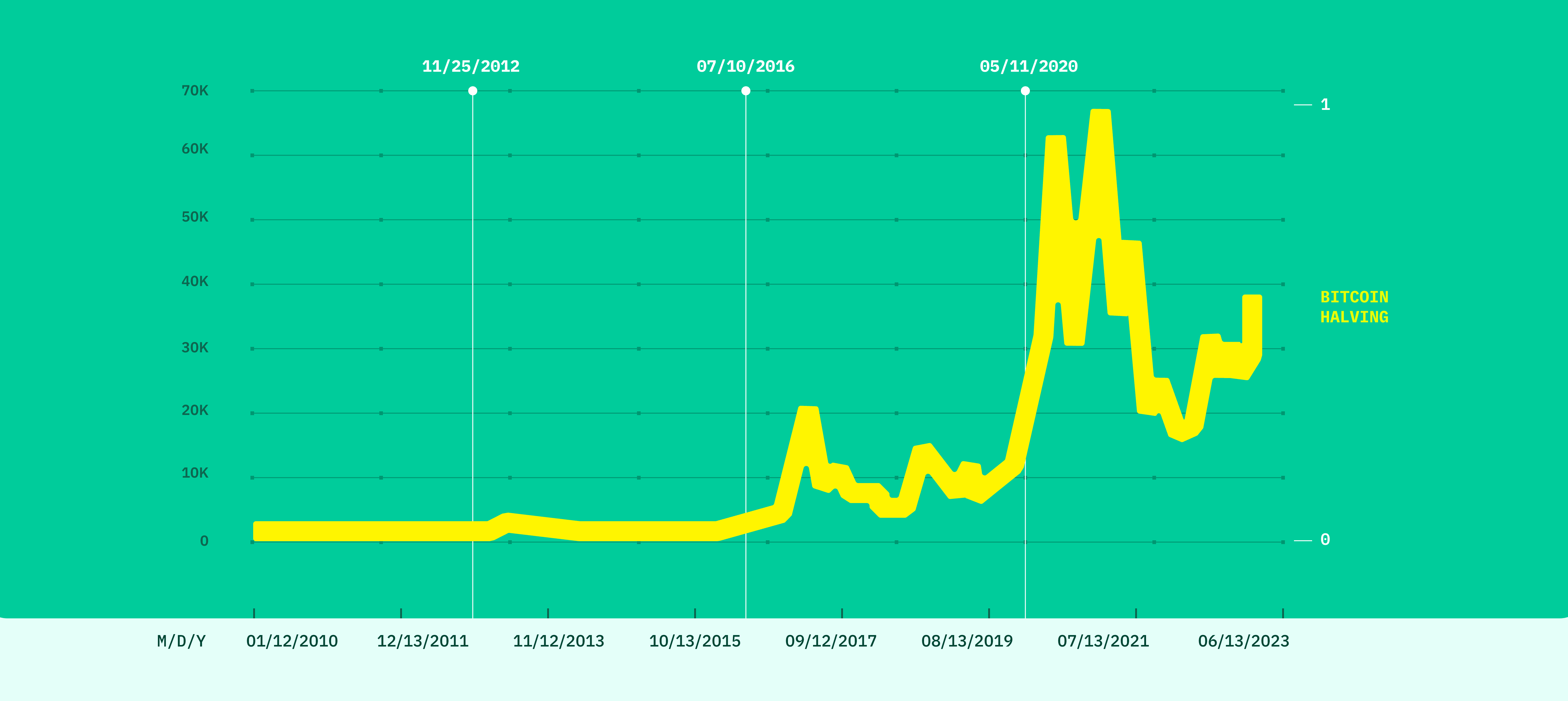

The price of bitcoin saw a parabolic rise in the periods following each of its three previous halving events.

Bitcoin’s fourth halving is expected to take place in April 2024. The upcoming halving will decrease bitcoin’s mining reward from 6.25 bitcoins to 3.125 bitcoins, thus lowering the supply of new bitcoin entering the market.

The halving is a reaffirmation of one of bitcoin’s fundamental truths and greatest value propositions: bitcoin is predictable, reliable, and trustworthy.

We will witness another great milestone in Bitcoin’s lifecycle this April.

How might technological advancements and global economic changes influence the 2024 Bitcoin halving market response, and do you anticipate it diverging from past cycles, with consequential effects on the cryptocurrency industry and the broader global economy?

Jason Williams | @GoingParabolic

Investor and Author, Bitcoin: Hard Money You Can’t F*ck With

The pending Bitcoin spot ETF is aligned very nicely with the halving event. Typically 180 days post the halving we have significant Bitcoin price movement. This would coincide nicely with a possible January 6th 2024 spot Bitcoin etf approval and the historical price action of the gold spot etf. It took about 2 years for gold to go parabolic after the approval. I think that event creates a real potential of a big move up. When

Blackrock's Bitcoin ETF is approved, they will need to acquire several hundred thousand BTC to fulfill end customer demand. There is no way they can acquire this much Bitcoin without moving the price significantly . This is the core issue they are actively working on now and part of my thesis on why bitcoin price could move way up. 20.76x from here gets us to $789,000 dollar bitcoin. Is that bullish enough anon?

Peter McCormack | @PeterMcCormack

Podcast host, What Bitcoin Did and Chairman, Real Bedford Football Club

As we approach Bitcoin’s fourth halving event, all eyes are on mining as this year has seen a significant increase in hash rate.The upcoming halving, which will see the block subsidy fall to 3.125 bitcoins per block, could put pressure on the financial sustainability of mining companies. However, the rising Bitcoin price, spurred by ETF speculation and other macroeconomic factors, coupled with a growing demand for block space that has seen mining revenues grow. If this growth is maintained, miners could successfully sail through this halving while maintaining strong margins.

While many regulators globally have made strides towards regulating crypto over the past year, the EU stands out both for its influence in traditional global markets and the quality and thoughtfulness of its approach.events..

In April 2023, the EU passed MiCA which was hailed as the most significant crypto-specific regulation to date.

A regulatory regime that is hostile to crypto will not only drive good actors offshore, but could create an existential threat for the economy as the artificial intelligence revolution beckons and the next wave of value creation emerges from Web3 innovation.

The U.S. is at a crossroads when it comes to crypto regulation. Regulation by enforcement fails to provide needed clarity or protect consumers while chilling innovation.

How do you anticipate the regulatory landscape for crypto to evolve in 2024?

Ji Kim | @_jikim

General Counsel & Head of Global Policy, Digital Assets Crypto Council for Innovation (CCI)

One of the bigger stories in 2024 will be the continuation of the race to the top among jurisdictions competing to become the key hub to digital assets and the financial system of the future. We’re already seeing this with the UK, EU, UAE, Japan, Hong Kong, Singapore, etc.–there is an ongoing competition among leading countries to have the most credible regulatory frameworks to attract commercial growth and innovation. There is a clear recognition by governments across the world that crypto and its related infrastructure are here to stay. The question now becomes which countries can cement their status as the key hubs.

These international developments will naturally start to influence U.S. crypto policy in a positive way. This past year, we saw increased bipartisan support in Congress regarding the need to create regulatory frameworks to foster responsible crypto innovation. Taken together, while the U.S. may be a few steps behind, progress is being made globally, and it is likely more a matter of when, not if, the U.S. will move forward with proactive crypto policy development. This necessity will become even more obvious over time given ongoing judicial losses for the SEC, which underscores the limitation of regulation by enforcement.

Gillian Lynch | LinkedIn

Head of EU, Gemini

The industry has been battle tested over the last year, but crypto hasn't gone away. In fact as history has shown, the industry is most likely to emerge stronger with some much needed guardrails in place to protect all participants. While opinions on crypto and blockchain technology may remain divided, I believe most would agree that the industry needs regulatory frameworks with customer protection at their core, whilst achieving a balance between creating clear and consistent rulebooks, which ultimately work to foster innovation.

Hackers and scammers target anywhere they can find money. Crypto and web3 are no exceptions. In 2024, we will continue building frameworks and standards to raise the security state of the industry.

Attackers will find new and escalating ways to gain access to wallets and accounts. Unphishable multi factor authentication (MFA), like passkeys and Yubikeys, will become indispensable for Web3 companies and customers to keep assets safe.

The security industry will shift more of its focus towards Web3 security tools and protections. Some of these will be tools for security professionals such as Web3-focused SOAR (Security Orchestration Automation and Response) and detection platforms. Consumers will also see new tools and technologies to protect their Web3 accounts and assets, bringing the decades of Web2 security advancements to Web3.

More resilient security measures like the advancements in phishing detection represent some of the greatest opportunities in the industry. Careers in crypto security will be one of the fastest growing fields in coming years.

The Web3 industry is working hard to evolve security frameworks, guidelines, and best practices. Last year, Gemini partnered with other industry leaders to create the REKT Test, a tool blockchain companies can use to assess whether their project contains basic safeguards and complies with best practices for access control, key management, and safety against other vectors for hacker exploits.

What are the most prevalent threats, and what is your outlook for 2024?

Khaja Ahmed | LinkedIn

Chief Security Officer, Gemini

Critical personal information of most consumers has been stolen already in the myriad of hacks of major organizations in recent years and months. Social security numbers, email addresses, physical addresses, credit card numbers, credit profiles, medical histories and more are being traded by criminals. This has enabled scammers and crooks to launch finely targeted and ever more sophisticated attacks, and has added to the challenge of protecting consumers from being harmed financially. Consumers have to become much more aware of the types of scams coming their way, and service providers have to be much more on guard to detect if any of their customers’ accounts has been taken over by an attacker.

Shaun Blackburn | LinkedIn

Director of Cloud Security, Gemini

We are starting to see classic impersonation attacks escalate as generative AI such as ChatGPT makes it easier than ever to write a convincing phishing email or even produce a realistic video impersonation of any person. This represents a new evolution of attackers using the tools available to conduct simple campaigns that trick users into giving away access. Even so, I am really excited about the industry’s progress towards passkeys to provide a simple, accessible security solution for all. It’s such an easy protection that dramatically increases security.

What trends do you anticipate will take the spotlight in 2024?

Balaji | @balajis

Angel Investor and Author, The Network State

A sovereign debt crisis is underway, it just hasn’t been widely recognized. A parallel global financial system becomes much more important if we experience a replay of 2008 with no parachute.

Will Clemente | @WClementeIII

Co-Founder, Reflexivity Research

Bitcoin will be solidified as an institutional-grade global macroeconomic asset.

Luca Netz | @LucaNetz

CEO, Pudgy Penguins

I believe 2024 and beyond will be the year of consumer facing brands for crypto as I believe it’s the next necessary step for crypto to reach mass adoption. The industry needs to pivot away from a narrative of financial gain to a narrative around digital ownership and accessibility and I believe the consumer facing revolution in crypto will be pivotal in reframing that narrative.

Lady of Crypto | @LadyofCrypto1

Crypto Investor

The past 15 years have been a warm-up act; now, it's time for the main event. Mass adoption is here, and with it, we will see a deluge of web 2 mega-corps dipping their toes into crypto. I think gaming will be the first breakout sector to decouple from Bitcoin. Games have had basic digital currency and collectables since before crypto was a thing; the marriage of blockchain and gaming is inevitable.

Wale Swoosh | @waleswoosh

Research, Azuki

I think that gaming will be one of the big trends that will define 2024. Gaming has been and will always be the great Trojan horse when it comes to crypto adaption. Gaming is the area where the benefits of crypto are easy to understand and clear. I firmly believe that the trend towards Web3 gaming we are now seeing at the end of 2023 will not only continue next year, but will become even more pronounced.

Alex Finn | @NFT_GOD

Founder, 1% Better

I think in 2024 value will accrue to cryptocurrencies that actually unlock experiences. People will be less inclined to spend money on purely speculative assets. They'll first ask "what does this token unlock for me? Will it give me an advantage in an online game? Will it get me access to an elite community? How will this token improve my life?" We are now 10 years into serious crypto development, and actual products behind these tokens will finally emerge.

Wendy O | @CryptoWendyO

Host, The O Show

I’m very excited for Crypto in 2024. I really think the emerging trends we’re going to see are going to be with bitcoin, bitcoin ordinals, BRC 20 tokens, and GameFi (being able to actually own your assets you purchased in game and of course RWA). I think it’s super important to be able to own IRL assets and NFTs. Ordinals solve this problem. An NFT is an ordinal that allows people to own their assets - just like bitcoin allows people to own their money.

We are grateful for all the industry leaders that contributed throughout this report. Thank you.

Utilizing the gold ETF market as a benchmark, and examining the correlation between year over year changes in gold ETF holdings and gold returns since 2004, we anticipate potential shifts in bitcoin's valuation following the probable approval of a spot bitcoin ETF. If we assume a quarter of percent of the U.S. Stock Markets $46 trillion market capitalization gets allocated towards the Bitcoin ETFs, this would result in $120 billion in holdings. Assuming the persistence of this observed relationship and accounting for bitcoin's volatility, we anticipate potential return would be 123% during the initial year of trading for the Bitcoin ETF.

This material is for informational purposes only and is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of Gemini. Gemini, its affiliates and its employees do not make any representation or warranty, expressed or implied, as to accuracy or completeness of the information or any other information transmitted or made available. Buying, selling, and trading cryptocurrency involves risks, including the risk of losing all of the invested amount. Recipients should consult their advisors before making any investment decision. Any use, review, retransmission, distribution, or reproduction of these materials, in whole or in part, is strictly prohibited in any form without the express written approval of Gemini.